The Case for CanadaBond

Download the full concept paper (PDF)

CanadaBond is a proposed digital platform that would allow individual Canadians to purchase treasury bills and bonds directly at primary auctions. This initiative restores the historical role ordinary citizens played in federal borrowing, offering the government an alternative funding channel alongside institutional investors. We are asking the Minister of Finance to direct a $2 million pilot under existing authority.

Background

Since confederation, Canadians have supported federal borrowing by directly purchasing government savings bonds. In 1868, the new Dominion of Canada called for tenders on $1,500,000 of 6% ten-year bonds. Sir John Rose, the finance minister at the time of the first bond issue, commented:

“The most gratifying feature connected with the distribution of the stock was that it was not taken up by speculators and capitalists, but was diffused over the whole country in small sums held by trustees and executors, charitable institutions, and individuals who thus invested their small savings. It had thus the effect of giving the public at large an interest in the permanency and stability of the institution of the country”.

This early commitment to broad, citizen-based participation in federal financing laid the foundation for a century of direct public investment in government debt. That legacy grew substantially during the world wars, when national savings campaigns mobilized citizens to purchase Victory Bonds in support of the war effort. In 1945, this momentum was formalized with the creation of Canada Savings Bonds (CSBs), with the program administered under the Retail Debt Program (RDP).

For much of the 20th century, the RDP offered Canadians a secure, low-barrier way to save while supporting public spending. But by 2015, the program’s operating cost had climbed to $58 million annually, representing 76 basis points of outstanding bonds. With bond yields around 1%, this administrative burden significantly reduced the net benefit to the government. The largest single expense was a $36 million Hewlett-Packard back-office contract that absorbed 62% of the program budget. As sales declined and fixed costs remained high, the program became more expensive than issuing wholesale bonds, and new sales were discontinued in 2017.

Since the program’s closure, individuals can only purchase treasury securities on the secondary market through brokers or ETFs, facing transaction fees that average around $25 per trade. Such fees effectively eliminate the value of investing small amounts, discouraging broader public participation.

In the U.S., TreasuryDirect serves as the official method for individuals to directly purchase marketable securities. Launched in 2002, TreasuryDirect enables individuals to place non-competitive bids in scheduled Treasury auctions in $100 increments. As of 2023, TreasuryDirect has 3.9 million accounts holding US $159 billion in securities. TreasuryDirect clearly illustrates how governments can offer direct retail access to securities markets efficiently and cost-effectively.

Build Plan

Canada Digital Service (CDS) will lead development of the CanadaBond platform, including the public-facing portal, secure book-entry ledger, and payment processing system. The platform will operate independently from the commercial book entry system and use direct payment routing through the Receiver General, enabling a parallel retail channel that integrates with Bank of Canada auctions without disrupting existing market infrastructure.

Frontend Mock-ups

Canada Digital Service (CDS) will lead development of a bilingual, accessible, and mobile-responsive CanadaBond frontend, using the Canada.ca Design System and drawing inspiration from TreasuryDirect.

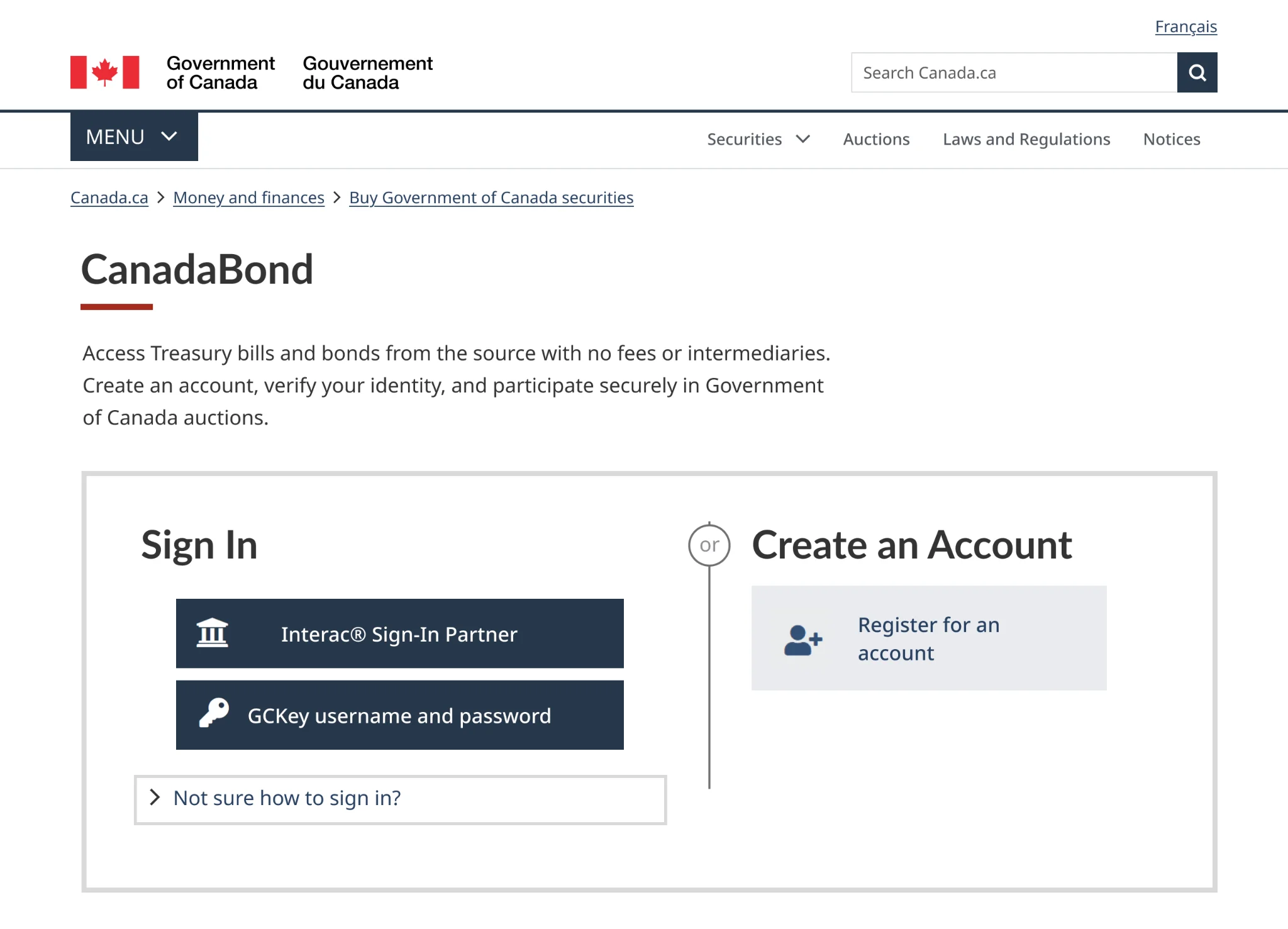

Front Page

The page will be hosted as a sub-page on the Canada.ca website. Users will be able to log in with GCKey or Interac Sign-In Partner.

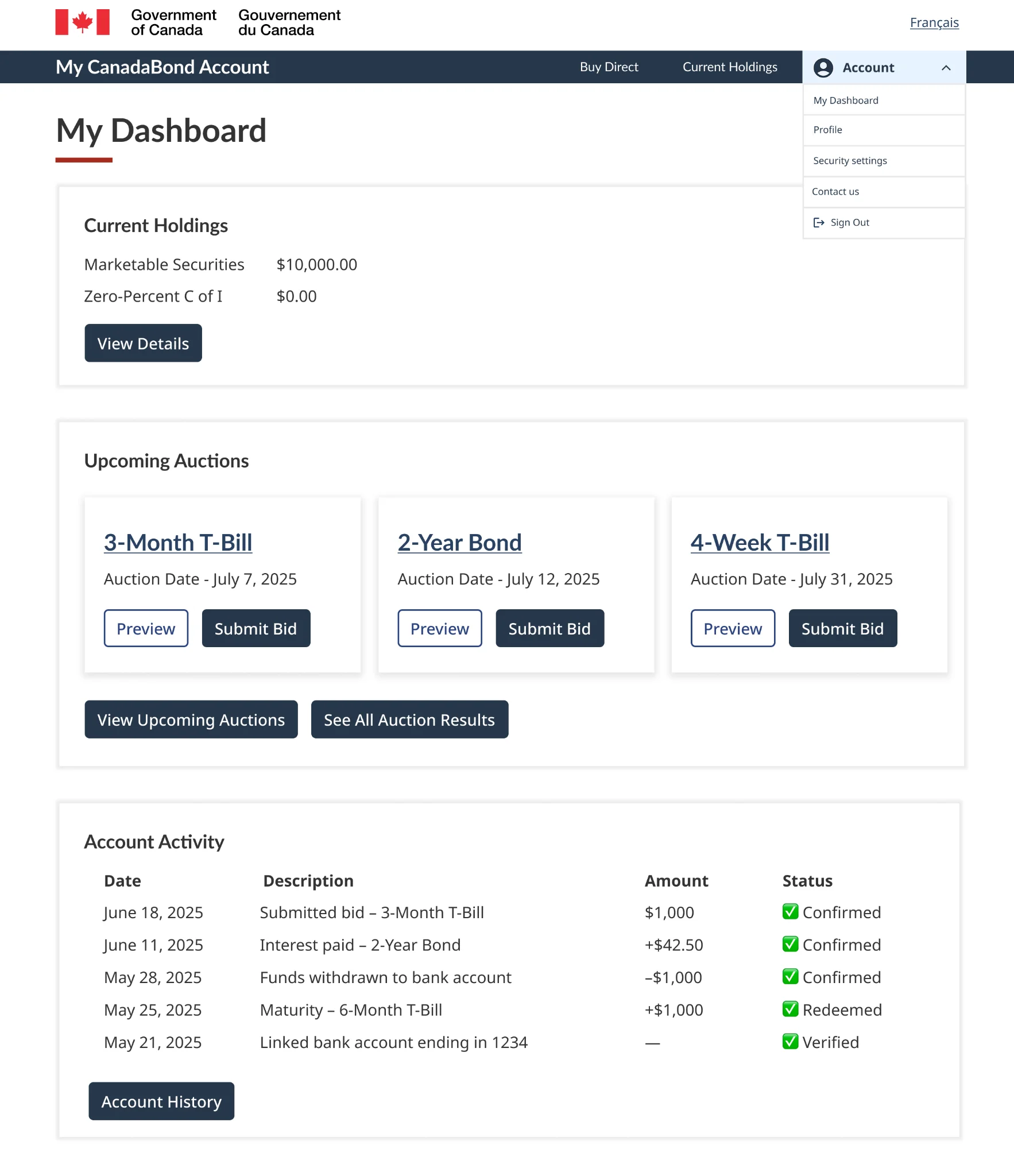

User Dashboard

Users will be provided a clear snapshot of their current holdings, upcoming auctions, and recent account activity.

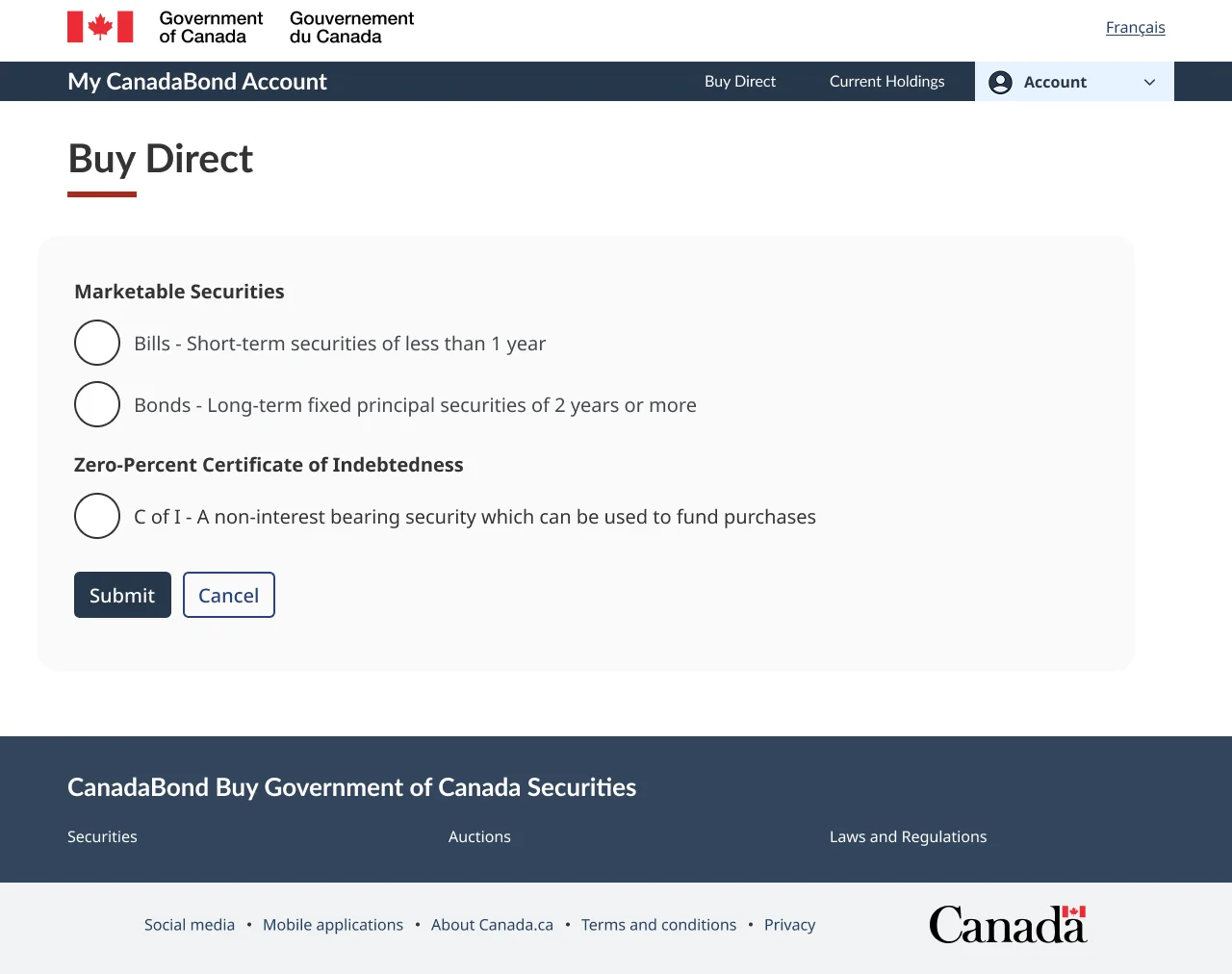

Buy Direct Page

Users will be able to choose between short-term bills, long-term bonds, or the zero-percent C of I.

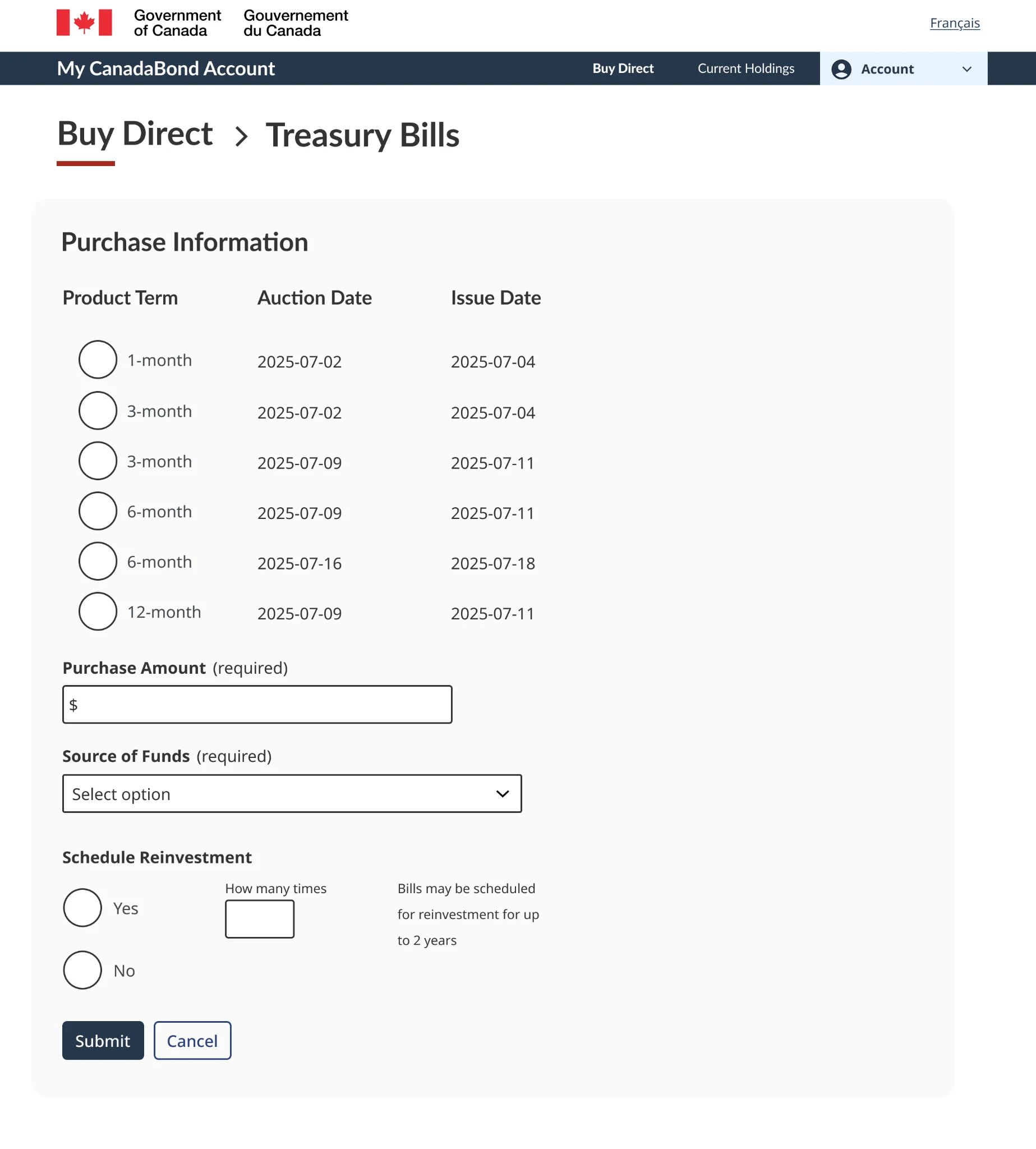

T-Bill Selection Screen

Users choose a term (1-, 3-, 6-, and 12-month) and enter a purchase amount. Users select a source of funds, and optionally schedule reinvestment.

Product Offerings

CanadaBond will offer access to Treasury bills (1, 3, 6, and 12 months) and Treasury bonds (2, 5, 10, and 30 years). The platform will also support Certificates of Indebtedness (C of I), a non-interest-bearing security used to hold funds between auctions.

Auction System

Canada Digital Service will lead development of a direct book-entry system to record ownership of securities held by retail investors. This system will operate independently from the commercial book-entry system and will not interface with the Bank of Canada Auction System (BCAS) for price-setting, as all retail bids submitted through CanadaBond are non-competitive. This allows the institutional auction process to continue unchanged. CanadaBond will require only the final auction result to settle retail purchases, while total retail participation figures would be reported back to BCAS. This mirrors how TreasuryDirect operates.

Payment Rails

Canada Digital Service will build the backend payment infrastructure to support secure, low-cost transfers between user bank accounts and the Receiver General. PAD (Pre-Authorized Debit) will be used to pull funds from users to pre-fund purchases, while direct deposit will be used to send coupon and maturity payments back to users. Both methods are reliable and cost-effective, with per-transaction fees typically around $0.25.

Identity Verification

Users will verify their identity through either Interac Verification (instant, bank-based), or Identity+ (document upload). Verification is required to meet Anti-Money Laundering (AML) regulations. Users must provide their SIN, which is used to prevent duplicate accounts, enforce investment caps, and for tax reporting.

Auction Integrity

The following safeguards are recommended for the initial rollout of CanadaBond. These conditions are expected to evolve over time and should be refined in consultation with the Bank of Canada:

- A T-5 cutoff will apply to retail orders.

- Each participant will be limited to $10,000 per auction.

- Retail participation will be capped at 10% of the total auction size.

- Securities will be non-transferable to the commercial book-entry system.

Call to Action

We request the Minister of Finance approve the $2 million CanadaBond pilot from existing budgets, direct immediate formation of a joint Finance Canada and Bank of Canada project team, and provide Cabinet with a progress report within 12 months.

For more information, visit canadabond.ca.